Cash – The “Sticky” Payment Technology

04 November, 2012

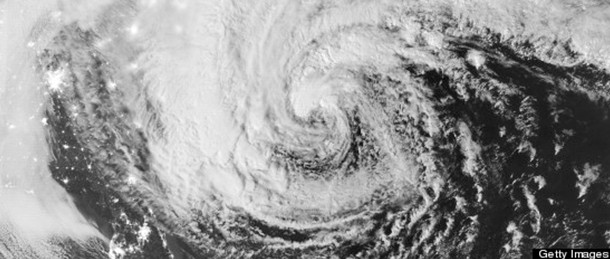

One of the great supporters of the worldwide use of cash is ATMIA (ATM Industry Association). In a recent video ATMIAÂ documents not only the duration of cash as a payment medium (27 centuries and counting!), but highlights the fundamental reasons that cash is a “sticky” technology. For all the pundits that promote the imminent demise of cash in favour of paperless payments, not a one of them addresses how the unbanked and credit-less peoples of the world would survive without cash. Last week we watched with held breath as hurricane Sandy assaulted the north-eastern US coast and wreaked havoc as far north as Toronto (my back yard). Early warnings from the Red Cross and other emergency response groups echoed three critical recommendations – “stockpile at least three days worth of food, water and cash” – not food, water and credit cards / debit cards / smartphone payment apps. Why did they recommend three days supply of cash? For the simple reason that cash is the only ubiquitous form of payment. If the lights go out and electricity fails, cash is the only form of payment available to everyone. In such a “dark” scenario, it will always be accepted no matter the purchase need. There will always be challenges with all forms of payment – counterfeiting chief amongst them. With advances in currency security devices, both covert and overt cash remains as the least vulnerable payment choice. We have the ability to judge any note for authenticity, unlike every other form of payment where simple physical examination will not indicate authenticity – credit and debit cards can be cloned, as can smartphones – payment apps can be hacked and balances stolen – story after story in the media lay bare the truth of this statement. I for one believe that cash will survive for much longer than Visa or Mastercard would hope for. After all, if it didn’t we would all have to look for new careers!